- Surface Area

- Posts

- Bloomberg's Yellow Keys

Bloomberg's Yellow Keys

In 1983, Mike Bloomberg unveiled a desktop computer that would revolutionize financial markets.

Known as “the terminal,” it was instantly recognizable because of an iconic keyboard that included yellow keys for each major market.

Something largely forgotten is that almost none of the yellow keys worked when the product first launched and wouldn’t for years.

The decision to build and ship hardware way before the software and data needed for the product was ready is a case study in vision, ambition and disregard for convention.

I didn’t join Bloomberg until 1990, but I’ve heard stories from many early employees including senior sales execs like Stuart Bell, Glen Wolyner, Dana Neuman and Jeff Cohen.

The keyboard – called the Chiclet – sported yellow keys for the major markets: commodities, equities, municipal debt, preferred, mortgages, money markets, governments, corporates and currencies.

In the beginning, however, the ONLY yellow key that worked was for government bonds (GOVT).

The rest of those products weren’t completed for another three to seven years. They were added as Mike hired specialists in those areas.

Effectively, the hardware was built and shipped years before the software and data for other products was ready. It was a form of physical vaporware.

It’s hard to overstate how crazy that seems. Google sometimes releases functions in “beta.” But they don’t release a menu of applications that haven’t been built and may never be launched.

Stuart Bell, the company’s first sales person, said that when clients asked about the yellow keys that didn’t work, “we said they would be ready next year.”

Stuart told me clients didn't care. The government bond data and calculator was so magical clients would overlook the phantom keys on the machine.

Munis were added in 1987 with the acquisition of Sinkers, a Princeton-based company owned by John Aubert. The mortgage product was built by refugees from the collapse of Drexel Burnham Lambert. Equities were added later.

Until I heard this story, I hadn’t understood how much the development of the terminal hinged not just on client demand but on when specific individuals joined the company.

It’s hard to imagine when you see the financial data behemoth Bloomberg has become, but the vaunted platform with its keyboard that is now in the Smithsonian was built piecemeal, one market stacked upon the next.

I think there are several lessons for entrepreneurs.

First, it’s good to have a long term vision of where you want to go.

And it’s good to be unafraid to commit to that vision mentally and physically.

But it’s also ok to build things brick by brick, seizing opportunities and iterating as you go.

(Part of a series of lessons learned from three decades at Bloomberg)

BRIEF OBSERVATIONS

TECHNOLOGY: Technology changes incrementally every day so persistently its hard to remember when the major changes occurred. But its obvious when you zoom out.

AMERICA IS SPORTS: Everything in America seems to revolve around sports, even betting.

VIBE CODING: We crossed a new threshold with the emergence of Claude Code and everyone seems to be building their own apps.

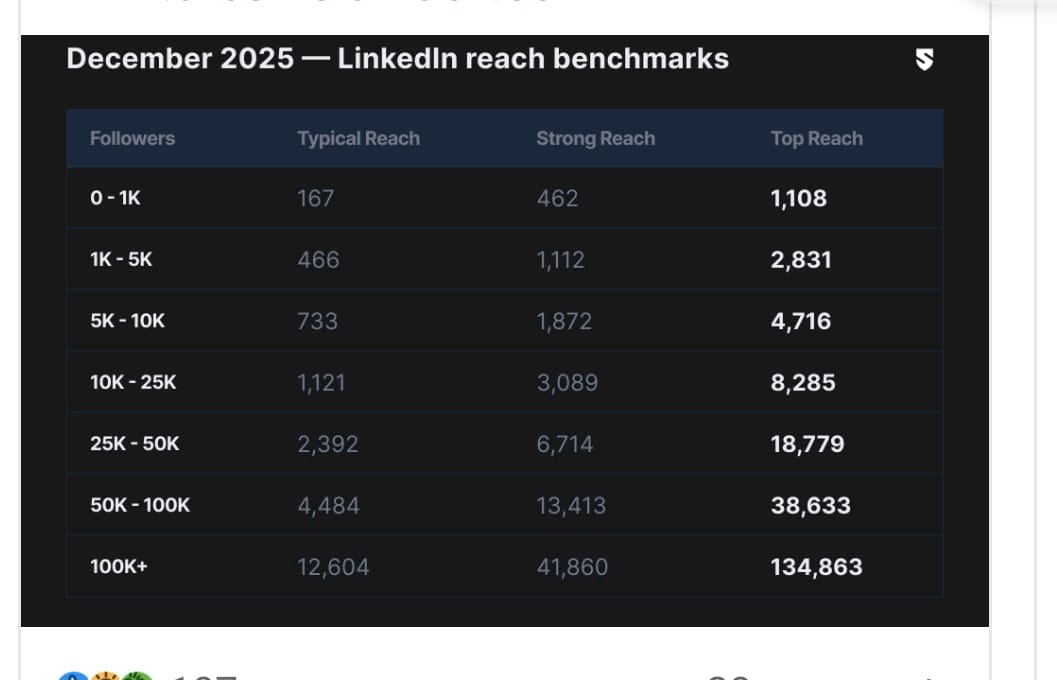

HOW MUCH ENGAGEMENT IS GOOD: A friend asked me the other day how much engagement a typical LinkedIn post should get based on his follower count. I had no idea, but then I found this online research which helped.

DON’T THINK ABOUT VIEWS: Agree whole heartedly with George Mack on this. If you are writing online you should do it to make an impact or connect with people, not to generate low-calorie views.

Please reach out if you have any thoughts about today’s newsletter. I enjoy hearing from readers. Send me a message if you want to talk or meet up if you are in NYC.

I would love it if you could share this newsletter with a friend.